4 Business Pioneers Who Changed The World For The Worse

Say what you will about the shady dealings of folks like the Walton family or Jeff Bezos, but at least their companies actually meet a demand. On the other hand, the world would definitely be a better place had these titans of industry opened bowling alleys instead.

Jay Van Andel And Richard DeVos

Multi-level marketing companies (or MLMs) ae stuff like Mary Kay, LuLaRoe, Avon, Herbalife, Cutco, etc. They all follow the same business model of promising people an amazing opportunity to be their own boss distributing their products, but the real money is in bringing in other distributors to get a cut of their sales, who in turn bring in other distributors, and so on until the organizational structure looks suspiciously like a, uh, "ziggurat of plans."

This brings us to the biggest thing these companies have in common: they all get a bit prickly when you even remotely imply that their business scheme appears slightly like a cone with a polygonal base. In their defense, that label is a tad unfair. Actual pyramids are stable structures that are not nearly as obtuse. On the other hand, just like pyramids, MLMs are largely built on the backs of unpaid labor, and the bigger they are, the more people speculate about how they were able to pull it off. It turns out, nearly all of them have been following the blueprints designed by the biggest name in the game: Amway.

Don't Miss

Amway was founded in 1959 by Jay Van Andel and Richard DeVos, two lifelong friends and business partners who had spent the previous ten years as distributors for another MLM, Nutrilite food supplements. Sensing a growing instability in the Nutrilite brand, Van Andel and Devos sought to break out on their own and create their own MLM with a line of products to sell to their already established customer base. And much like Morrissey’s solo career, it didn’t take Amway long to become both a household name and totally radioactive. (We won't even mention what product Amway sells because, frankly, it doesn't matter.)

In the six decades since its founding, Amway has faced, by their own lawyer’s admission, thousands of lawsuits over their business practices. Most notably, a 1979 FTC investigation concluded that Amway did not meet the legal definition of a pyramid scheme, but only by a narrow margin. One example being, if it were a pyramid scheme, participants would be paid a headhunting fee for recruiting other participants. Instead, Amway only gives their “Independent Business Owners” a percentage of the sales of the people they recruit. See? Huge difference.

Amway has spent hundreds of millions of dollars over the past six decades paying fines and settling lawsuits over their business practices, and to their credit, they have made changes to their business model each time to correct those issues. The problem is, they only change juuuuust enough to keep themselves within the letter of the law. At the same time, the families behind Amway have been donating tons of cash to anyone in Washington who might help them move the legal goalposts.

White House

Pretty much any politician, PAC, and Super PAC in the past few decades that has ever called for tax cuts for the rich or for federal regulators to eat a bag of dicks is practically guaranteed a maximum donation from every subsidiary of Amway and various members of the Van Andel and DeVos families. Richard DeVos served as the finance chairman for the Republican National Committee. His daughter-in-law Betsy DeVos was Secretary of Education during the Trump administration, and her confirmation hearing was a fierce 3.5-hour-long debate over whether her bank account qualified her for the job. Jay Van Andel and his son Steve each served as chairman of the U.S. Chamber of Commerce, the largest lobbying group in America and an organization that’s so anti-union they consider Labor Day to be a day of mourning.

The DeVoses were obviously huge supporters of an amendment to the Financial Services and General Government Appropriations bill which would’ve limited federal agencies’ ability to take any enforcement actions against, um, "Khufu-esque machinations," essentially deregulating the MLM industry by default. The bill, ironically called The Anti-Pyramid Promotional Scheme Act of 2016, fortunately died in committee before it could be brought to a vote, but it should come as no surprise that most of the co-sponsors of the bill received campaign contributions from either Amway, the Van Andels, the Devoses, or all of the above.

Coco Chanel

Between reality TV, tabloids, and social media influencers, it seems like trashy celebrity hijinks have become one of America’s biggest industries right now. Scandals that would end a career 30 years ago are considered a brilliant PR move today. People are now getting rich and famous for living rent-free inside our heads, and trying to evict them only makes their behavior worse.

However, there was one woman whose life was chock-full of the kind of hot mess drama alert content today’s celebrities could only dream of achieving. And not only did she use it to her full advantage at every turn, she managed to put every modern influencer to shame a full century before Instagram was even a thing. She’s been dead for forty years now and her name is still on everyone’s lips, clothing, jewelry, and handbags: Coco Chanel.

Like many internet celebrities today, Coco’s fashion career was her backup plan after failing in show business. Around 1906, she was working as a seamstress during the day, but at night she was trying to become a cabaret singer. She was singing at a club in Moulins frequented by cavalry officers, and it was there she met Étienne Balsan, an officer who was also an heir to a French textile company. She became Balsan’s mistress, he showered her with gifts and threw huge parties which tapped her into many circles of high society.

After three years, she began an affair with Balsan’s friend Captain Arthur Edward Capel, and the love triangle never tarnished the two men’s friendship because A) this was France, and B) Coco Chanel was remarkably good at playing both sides of any given situation (cough, cough, foreshadowing). Balsan helped her build a following and establish contacts in the textile industry, but Capel helped finance her first two boutiques.

The next part of the influencer playbook she wrote was collaborating with celebrities to help build her brand. She designed costumes for Igor Stavinsky’s ballets. In 1923, she was tapped into the British aristocracy, which introduced her to Winston Churchill, a friendship that would come in real handy down the road. Around this time, she also began an affair with the Duke of Westminster, which greatly expanded her social status. In 1931, a Russian Duke introduced her to Hollywood mogul Samuel Goldwyn, who paid her a million dollars (nearly $17 million today) to design costumes for the films he produced.

Another unfortunate and far too frequent influencer trend (looking at you, PewDiePie) that Chanel originated is getting a little too cozy with Nazi ideology. She was already known as a virulent anti-Semite, and her affair with German aristocrat and intelligence officer Baron Hans Günther von Dincklage made it pretty clear which side of the fence she was on. Declassified documents showed that Chanel was listed as a German operative, although there’s no evidence that she was given any assignments other than to act as a messenger to Churchill for a possible German surrender as the war started to turn for the Allies.

via Wiki Commons

After the war, Coco Chanel did what a lot of problematic celebrities do when a scandal gets too big for them to handle: retreat to a safe space and hope that friends will back them up. She fled to Switzerland to avoid charges for collaborating with the Nazis, and it is believed that Winston Churchill intervened to protect her. Not just because they were friends, but also out of fear she might expose any pro-Nazi sympathizers inside Britain’s government.

By 1954, Coco Chanel decided the dust had cleared enough on the whole Nazi business and staged a comeback in the fashion world. And her “We cool now, right?” tour obviously worked because the Chanel brand is still going strong at over $13 billion in revenue this past year alone. Suppose it helped a bit that she didn’t actually design any clothes for the Nazis like Hugo Boss did. That brand only pulled in $2 billion last year.

Albert L. Lord

As of the time of this writing, American college students collectively owe an estimated $1.7 trillion in student loan debt. That’s more than twice the annual budget for the U.S. military. That is almost five times more than the box office totals of every movie Hollywood has ever made. If you were to try to pay that off using every piece of U.S. currency in circulation right now, you’d still be $500 billion short. If you could somehow literally shit gold, depending on fluctuating market value and your fiber intake, it would likely take you 196,000 years to … look, It’s a lot of goddamn money. You get the point.

How did it get this bad? Well, in 1972, the Student Loan Marketing Association (or SLMA, or Sallie Mae as some dork started calling it around the office, and the name somehow stuck) was started as a government-sponsored enterprise that granted, serviced, and collected federally guaranteed student loans on behalf of the Department of Education. In 1997, Sallie Mae started privatizing their operations, and by 2004, they had ended their ties to the federal government. It wasn’t a bitter breakup, because both parties have remained friends with benefits ever since.

Investor groups, private equity firms, and banks got involved and wanted to turn a profit. College costs started soaring because income stagnation made it necessary to have a degree to make a living wage. Sallie Mae started raising their interest rates. Laws were passed making it harder to declare bankruptcy on student loan debt. Obviously, there is a long list of people to blame for this nightmare, but if there is one man who had the most to gain out of it, it’d be Albert L. Lord.

By the time Sallie Mae had started the privatization process in 1997, it was managing about $48.7 billion in student loans. Lord had been with the company for eighteen years at this point, and had just been installed as CEO. By the time the company was free from governmental restraints in 2004, Sallie Mae was managing more than $107 billion in loans, and Lord had already taken home over $200 million in compensation.

Under Lord’s leadership, Sallie Mae did everything they could to dominate the student loan market, mainly by trying to kneecap the competition through aggressive marketing. They placed their own employees at university financial aid call centers, sponsored cruises for college loan officers, and even paid colleges to drop out of any federal loan programs and exclusively use Sallie Mae. If any of these practices seem like the kind of thing Congress should really do something about, don’t hold your breath. Because Sallie Mae’s own political action committee had already paid over $6 million in campaign donations to the very lawmakers who could do anything about it. And who was in charge of that PAC? You guessed it: Albert L. (five minute stream of expletives) Lord.

But perhaps the most infuriating thing about Albert L. Lord comes from this Wall Street Journal piece where Lord whines about the high cost of his grandkids’ college tuition and glibly pontificates on how a college education got to be so gosh-darn expensive, by golly! Seriously, it’s like every “OK Boomer” meme made sweet, sweet love to the hot dog car sketch from I Think You Should Leave. For the sake of your sanity, it’s best to read this article with frequent breaks to let out a primal scream into the void.

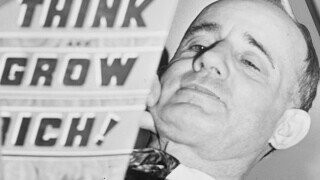

Napoleon Hill

Self-help books, particularly business financial success books, are a huge industry. They are also, by and large, absolute BS. They may contain the occasional nugget of practical advice, but for the most part they are just motivational porn designed to get you pumped up on thinking like a winner, and spending $20 on a book is way cheaper than hiring a financial adviser or booking a therapist. Now, if you're a fan of self-help books, that’s fine, we’re not kinkshaming here. But the fact remains, if you’ve had to read more than one, they're obviously not that effective.

There is an argument to be made that self-help books technically date back to the days of the ancient philosophers. But the more modern movement, where best seller lists, tie-in seminars, and paperback deals became a factor, started with a man named Napoleon Hill and his 1937 book Think and Grow Rich. It has sold millions of copies, and the way it was written (and marketed) has provided the genome for every book on personal development ever since, despite the fact that Napoleon Hill was a massive fraud.

Think and Grow Rich was actually Hill’s third book. His first, titled The Law of Success, was originally published in 1925 as a set of 15 booklets adapted from a series of Hill’s lectures and later consolidated into a single volume. In 1930, Hill published The Magic Ladder to Success, which basically distilled the philosophy of The Law of Success into more of a step-by-step guide, hence the ladder metaphor. Think and Grow Rich was basically a more mainstream, flowery repackaging of the same damn philosophy. People ate it up, and Think remains on a lot of success guru must-read lists to this day.

Mindpower Press

Hill had claimed that his work had been based on his years-long correspondence with the late industrialist Andrew Carnegie. This raised a lot of eyebrows because most of the advice attributed to Carnegie in the book contradicted nearly everything written about his business philosophy, and even by himself in his own autobiography. When critics pressed Hill to provide proof of his correspondence with Carnegie, Hill claimed that the letters were destroyed in a fire. Sure they were.

But like most success gurus that exist today, Napoleon Hill was really only a success at writing books and holding seminars on how to be successful. Behind that veneer, he was a con artist who spent his entire life going from one scam to another, including mail fraud, theft, securities fraud, as well as forays into the other garbage industries on this list. In 1909, Hill founded the Automobile College of Washington, where he scammed students into building cars for the Carter Motor Corporation and paying for the privilege under the guise that they were gaining an education. He would often recruit new students though his other students, like a pyramid scheme. If a potential student was unable to afford the tuition, he offered them student loans at interest rates that would make Sallie Mae envious.

Not that he was conspiring with Nazis like Coco Chanel, but Hill was innovating the influencer tactic of leeching off any type of celebrity clout he could get. He bragged about having worked as an advisor to Presidents Woodrow Wilson and FDR, even taking credit for writing the line “The only thing we have to fear is fear itself.” Of all of the famous men he claimed to have collaborated with (Henry Ford, J.P. Morgan, John D. Rockefeller, etc.), the only one he had any proof of ever meeting was Thomas Edison, and Hill had to create a fake award to present to him just to get the photo op.