5 Times ExxonMobil Almost Took Over The World

ExxonMobil is one of the most powerful companies on the planet, and it's easy to make them out to be the bad guy, what with all the pollution, environmental damage, and donating to any politician who'll help them get ahead no matter what other policies they promote. The branding doesn't help either: "Exxon" sounds like the name of a sci-fi warlord. But apart from all of that, why should we fear it? Well, believe it or not, it has in the past come close to achieving global (or at least market) domination ...

The Fall Of The Empire

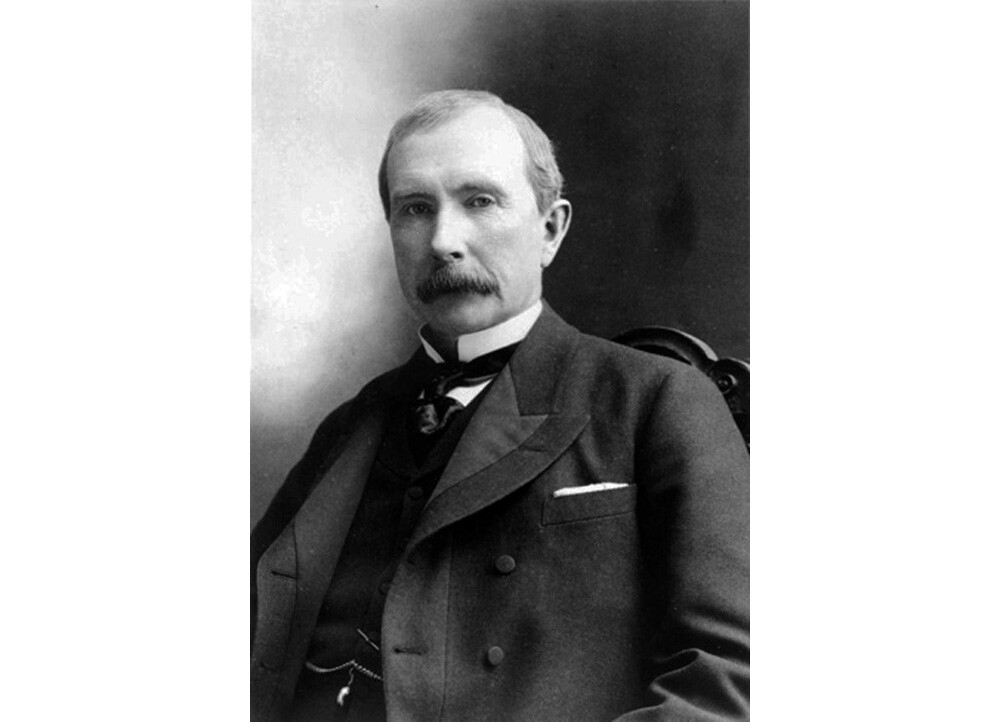

In 1911, John D. Rockefeller was forced against his will to become the richest man in the world.

Don't Miss

Rockefeller was one of the chief architects of the trust, a system of interstate business ownership and board memberships that allowed him and some close allies to circumvent much of the regulation of business that existed within the US during the 19th century.

By exploiting legal loopholes and the ownership of railroads to severely undercut the prices of competitors until they went out of business, Rockefeller and the other Standard Oil owners were able to dominate the extraction, refinement, and sale of oil products ranging from kerosene lamp oil to Vaseline petroleum jelly across the US. Electricity, fuel for transportation, lighting, lubrication … it was almost impossible to participate in industry without Standard Oil making a profit at some step of the journey.

It took the 1890 Sherman Antitrust Act and a series of legal decisions culminating in Standard Oil Co. of New Jersey v. United States finally being decided by the Supreme Court. The result was 34 separate oil companies which had previously been a single one that represented "only" 70% of the global refined oil market. Rockefeller's shares in Standard Oil were split proportionately among the new companies. Within a decade, Rockefeller's 25% stake in one company became $900 million from a forcibly diversified portfolio. That's $13,660,692,737.43 in 2021 dollars adjusted for inflation (which, in all fairness, is still just a fraction of Jeff Bezos' hundreds of billions, but hey, a new house cost less than $7000 back then).

Rockefeller would continue to wield massive power and influence, but it was diminished considerably by the breakup of Standard Oil. But the Standard Oil Company of New Jersey would, of all Rockefeller's descendants, hew the closest to his rapacious legacy of exploitation. Better than his human descendants, at any rate, who may have a guilty conscience.

Mergers & Acquisitions

If you looked at the corporate family tree of ExxonMobil, you might be surprised to notice it looks mildly incestuous. Exxon and Mobil, both rebranded regional Stand Oil Company fragments, re-merged in 1999, while some of their … cousins ...? siblings ...? banded together into Chevron or were bought out by the oil company formerly known as British Petroleum.

These three companies all have scandals and environmental disasters that Rockefeller could only have dreamed of. The Exxon Valdez, the Deepwater Horizon, and the years-long house arrest of a lawyer who dared win a case over oil spills in Ecuador. That's ExxonMobil, BP, and Chevron, respectively, each causing unfathomable amounts of environmental damage and getting away with paying some fines and lawyers and maybe taking a hit in stock prices. They may not exert as much influence through a single company as Rockefeller's Standard Oil did, but they're all remerging into incredibly powerful entities that can seemingly operate while avoiding consequences.

And what's more, because their stock is so valuable, it means that even if you don't personally hold any stock directly in these companies, or ExxonMobil in particular, their prices still matter to you. If you work for or attend a private university, they most likely have some of their endowment tied up in fossil fuel stocks. If you have a 401k, at least some of that value is determined by fossil fuel stocks, ditto retirement funds of various sorts, and just about any other financial institution you'd care to think of.

You usually hear it in terms of banks, but ExxonMobil and its family members are "too big to fail." So big and important, in fact, they're in line to get $25 billion in subsidies from the latest supposedly green infrastructure bill. It's almost harder to stop investing in fossil fuel companies than it is to stop using their products, though people are making an effort.

ExxonMobil Could Have Been Tesla But Bigger

At this point, most people are aware that Exxon knew greenhouse gasses released by their products would likely cause global warming 11 years before the general public. They're fighting that interpretation in the courts and in the media, of course. But the evidence (for anybody who doesn't need their money to win reelection) is pretty damning.

What fewer people are aware of, despite some efforts by ExxonMobil, is that it funded some of the research that led to the invention of lithium-ion batteries (Full Disclosure: while working for a marketing company ExxonMobil hired, I actually wrote their version of events).

Before Exxon knew about climate change, it was trying to figure out how to survive the OPEC oil embargo of the 1970s. In 1973, lines at gas stations were common, and while it meant Exxon could sell all the oil they could pump, it also meant that the prices were high enough that consumers started re-evaluating their relationship to gasoline. At the time, Exxon was excited about the prospect of the technology, but when the embargo ended, Exxon cut funding for much of their battery research.

However, they did incorporate a lot of what they learned into creating a pioneering hybrid car in 1978. This means that in the early '80s, when the Exxon board were having meetings over secret documents showing the inevitable onset of global climate change, they had in their hands not only part of a solution but also had the ability to absolutely CORNER the market on electric cars or at least plug-in hybrids.

Hindsight is 20-20, of course, but they had every piece of the puzzle on hand to leave oil behind and become a key partner for the future of automotive technology, but instead, they prioritized short-term profits. It's hard not to imagine what the world might have been like if they had had the courage to take risks with things besides oil spills.

The Exxon 500

While leading the world away from oil didn't appeal to Exxon's executives (exxecutives?) they still fancied themselves innovators and moved to create a line of personal computers. Today, the 500 series is a line of high-end hydraulic fluids, but that wasn't always the case. The Exxon 500 series of personal computers flopped despite being run with some of the most powerful hardware available at the time, and in the process, dragged a promising tech company down.

The story of Exxon's attempt to compete with IBM spans just a few years and ended in the selling off of chip manufacturer Zilog while writing it off as part of a $1 billion loss. What's wild is that the Z80 microprocessor developed by Zilog founder Federico Faggin is still in wide use today. Calculators, cash registers, and all sorts of classic computers and gaming systems all run on the Z80. You probably have a device or two operating on one in your house right now.

But Zilog never became the huge company that their technology promised, a problem Faggin blames on Exxon to this day. Turns out it is hard to be both a supplier of key components and a competitor to the same companies. The impact of this mismanagement is hard to determine. Maybe the Z8000 processors could have ushered in an earlier age of more advanced computing, or maybe it would've just been one part of a company expanding into ever more of the consumer goods market.

Imagine if it had been combined with their lithium-ion battery technology, and Exxon could well have been the company behind most of the important technology in the device you're reading this on right now. It's not clear if we'd be better off if we were driving Exxon EVs and calling each other on Exxon branded mobile phones or if the name would at least inspire our present to more closely resemble the cyberpunk future it secretly is, but it is hard not to be haunted by the possibility.

The Direct Route

Hey, remember Donald Trump's first secretary of state? It was Rex Tillerson -- who left his job as CEO of ExxonMobil in 2017 to become fourth in the line of presidential succession. He was eventually treated to the 45th president's famous "You're Fired!" but he was briefly one of the most powerful people in the world. Tillerson had a hand in shaping and executing US foreign policy, often with an eye towards supporting the oil and gas industry as a whole, if not ExxonMobil in particular.

Now, I do not have definitive proof that he took the role at the behest of ExxonMobil or did it specifically to advance their goals. I also doubt that there was any kind of plan to make him president directly, though I would note that if he had ideas about running for president himself later, it's not a bad thing to have on your resume.

But the fact is he was a very wealthy, very connected man who had a demonstrated history of loyal and effective service to a powerful company that influences our politics through millions of dollars in contributions and lobbying. It would be years of work and research and interviewing before I could confidently assert anything untoward or even grandiose involving Tillerson or the country.

So instead, I leave you with a conspiracy theory I feel far more confident about after limited research: Rex Tillerson is the inspiration for Tex Richman, the oil baron villain from 2011's The Muppets. If this feels like a silly point to make, Fox News spent seven minutes of airtime on it.

Which makes Gonzo's chicken banging the second-worst muppet background story.

Top Image: Justin/Unsplash