4 Supervillain-Tier Acts Of Evil By Famous Companies

We all know that big corporations are basically amoral. That’s why Amazon only allows employees one bathroom break a week, and it has to be done in front of a two-way mirror while sirens blare. That’s why Uber avoids providing benefits by classifying all its drivers as the CEO’s polygamous concubines. That’s why when you die, you’ll wake up in Hell with a demon in a Nike polo ordering you to get on the production line, because they’ve got a shoe contract to fill. But even if you think you’ve got a handle on this crap, big companies will still find ways to surprise you with their pure, money-grubbing evil. And we’re going to inflict some of that knowledge on you right now:

The Anime Industry Is Basically Indentured Servitude

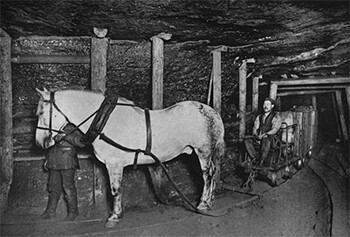

These days, it seems like the whole world has gone crazy for anime. At most high schools, you can now get wedgied and shoved in a locker for not showing up to picture day dressed like Alucard from Hellsing. Meanwhile, experts predict that the 2024 Olympics will be the first at which all the athletes run around with their arms at their sides like Naruto. World peace will be achieved that same year, when all nations agree to resolve their differences through high-stakes games of Yu-Gi-Oh. Yes, it’s anime’s world now, and we’re all just living in it. Which makes it especially shocking that the people who actually make anime have roughly the same working conditions as a 19th century coal mine donkey.

The anime industry itself is worth an estimated $24 billion to Japan’s GDP, but animators have complained for years that it’s completely impossible to make a living in the industry. An entry-level animator earns as little as $2 per frame, even though they regularly take an hour or more to complete. A recent New York Times investigation found that the average junior animator earns around $12,000 per year. A more senior artist, with years of experience in the industry, can hope to earn around $36,000 a year. And this isn't part-time work. One studio was criticized for requiring animators to work 100 hours a week with no days off for over a month. At another, an animator’s suicide was blamed on burnout after working over 600 hours in the previous month.

Bear in mind, this industry is based in Japan, which has one of the highest costs of living in the world. The average studio apartment in Tokyo costs 70,000 yen, a suitcase of cocaine and one of the shogun’s lost rubies. Per week. It is basically impossible to live on $12,000 a year. But anime is so popular that there are thousands of young people entering the industry every year, hoping to make it as animators. Most burn out after a few years, to be replaced by a new wave of eager young people. As a result, studios feel almost no pressure to increase wages, even if half of their employees are living in the heating vents eating ink soup for every meal.

Kobunsha Publishing

This is all despite the fact that anime is booming right now, with viewership skyrocketing worldwide and most studios booked solid for months or years in advance. But even as profits soar, things are so bad that many aspiring animators have to rely on charity to survive while earning as little as $38 per day. We’re not saying you should feel bad for watching 40 hours of One Piece a week, as we all do. Just don’t be surprised if you pause in the wrong place and notice a desperate plea for UN food drops scrawled on the background of a frame.

Nestle Is Stealing Florida’s Water

Ginnie Springs is a stunningly beautiful tributary of Florida’s Santa Fe River. Tubers and kayakers have long flocked to the crystal clear waters of the springs, while holiday campsites dot the surrounding woods. Turtles bask along the banks, as scuba divers delight in exploring the magnificent limestone caves. Also Nestle are there, drop-kicking turtles out of the way while frantically shoveling water into a big van marked “Kylie Jenner’s all-Perrier swimming pool.”

It’s no secret that America’s rivers are in crisis. A recent study found the Missouri River the driest it's been in 1,200 years. The Colorado River ran untroubled into the Gulf of California for six million years. These days, it failed to reach the sea for 16 consecutive years between 1998 and 2014. These problems aren’t directly caused by companies like Nestle, but recent efforts to protect America’s water sources have been hampered by the massive bottled water boom, which drains billions of gallons of water from springs and rivers every year. For example, in 2019, Nestle’s Arrowhead bottled water brand sucked over 45 million gallons from California’s Strawberry Creek system, leaving many creek beds “bone dry.”

Wild As Light/Shutterstock

The problem is especially bad in Florida, where the state government has been particularly eager to grant extraction permits to bottled water companies. Which is why Nestle was recently approved to extract almost a million gallons a day from Ginnie Springs, despite the fact that local aquifers are already dropping by an inch a year, while the Santa Fe’s average river flow has decreased by at least 30 percent in the last few decades. In return for giving Nestle this lucrative deal, the state government will receive a one-time payment of exactly $115. No, we did not forget any zeroes. That’s even worse than Nestle’s deal in Michigan, where they have to pay a whopping $200 a year in exchange for siphoning over 400 gallons of water per minute. Again, that is the correct number of zeroes.

In the company’s defense, they dispute the crazy notion that a river should have water in it, with a spokesman noting “the argument that there should be some flowing stream bed – we don’t necessarily believe that.” He presumably went on to caution against becoming addicted to water, lest it take hold of you and you resent its absence. And while environmentalists insist that Ginnie Springs will be destroyed by the massive water extraction, Nestle argue that any problems will be more than justified by all the jobs the project will create. And we guess that’s true, in the sense that “wasteland raider” and “Bone-King of the Salt Plains” will technically be pretty good jobs in the future.

McDonald’s Is Trying To Smash A Minimum Wage Increase

McDonald’s was founded on in 1940, when an insane clown put up signs for a burger restaurant to lure hitchhikers into his murder basement. Luckily, the burgers turned out to be such a huge hit that the guy gave up on his chainsaw dreams and made millions off a franchise deal instead. We’re not sure if any of that’s true, but what we do know is that McDonald’s is now one of the biggest companies in the world, with hundreds of thousands of workers in the US alone. Many of those workers are paid even less than a common anime artist, which is why McDonald’s has been at the center of the ongoing Fight For $15 campaign seeking to raise the minimum wage.

Now, McDonald’s say they have no opinion on Fight For $15 protests, noting that the workers are employed by local McDonald’s franchises, not by McDonald’s itself. It’s nothing to do with them! At least that’s what they say in public. Behind the scenes, McDonald’s has actually unleashed its top-secret legions of burger operatives to spy on the protests.

McDonalds

According to an expose in Vice, McDonald’s has intelligence units based in Chicago and London tasked with monitoring Fight For $15 activities. The units use social media monitoring tools to track McDonald’s employees sympathetic to the movement. According to Vice, this included using fake Facebook profiles to befriend workers involved in protests in order to “reconstruct their friends lists and networks.” (McDonald’s specifically denies using fake profiles, but otherwise admitted to monitoring employee involvement in the movement.)

McDonald’s isn't even exceptional in spying on their employees like this. Uber used to have something called the Strategic Services Group, which has been accused of hiring ex-CIA agents to bug hotel rooms and spy on “politicians, regulators, law enforcement, taxi organizations, and labor unions in, at a minimum, the US.” Walmart has a black site known as the Bat-Cave, where it monitors employee communications, including private Gmail accounts. So just remember, you may feel unimportant scraping a living in a badly paid service job, but all you have to do is tweet about raising the minimum wage and there’ll probably be twelve former FBI guys assigned to catfish you on Tinder before the week is out.

Texas Deregulation Left Customers With Massive Energy Bills

The 2021 Texas winter storm was a once-in-a-lifetime event, assuming you die immediately after reading this sentence. And while the freezing conditions were unexpected, you might expect the world’s wealthiest country would have the resources to deal with being snowed at. Unfortunately, that’s not how it turned out, as millions of Americans found themselves without heat or running water. The problems were particularly bad in Texas, where Ted Cruz crammed the entire power grid into his suitcase and fled to Cancun, leaving Texans with no choice but to declare that the age of the Christ-King had ended and burn their neighbors in a wicker man to appease the sun gods. But even if you were one of the lucky ones and had heat throughout the storm, you could still be facing life-ruining power bills.

Texas is unusual in that it has a completely independent state power grid, which has been called an “electrical island in the United States.” By isolating their power grid, Texas has been able to avoid regulation by the Federal Power Commission, which oversees the linked grids in the rest of the continental US. As a result, Texas can run a completely deregulated power grid, allowing any number of electricity providers to operate, often with little oversight. But when the storm knocked out natural gas and wind energy producers, the independent grid meant that Texas couldn’t get power from neighboring states. Instead, the state allowed the price of electricity to increase by an insane 7,400 percent overnight.

This was supposed to encourage the remaining producers to supply more electricity. Instead, it encouraged power companies to pass the huge new prices on to consumers. The hardest hit were customers of a company called Griddy. Now Griddy might sound like an unsuccessful nu-metal band, or a knockoff hockey Azerbaijani mascot, but it was actually a fairly typical case of tech-startup brain poisoning. Instead of offering fixed-rate plans, Griddy would charge a flat $10 monthly fee in exchange for providing power at the wholesale market rate. If the cost of power went down, Griddy’s customers would pay less, whereas if it went up, they’d pay a little more. Well, unless the price suddenly went up by, let’s say, 7,400 percent. Then they’d be paying a lot more.

To make matters worse, Griddy automatically debited their customers’ accounts, which meant that people woke up in the middle of a snowstorm with their bank accounts empty and overdraft fees racking up. A guy in Dallas was billed $16,000 for a few days of power usage, while a teacher in Bedford faced $7,000 in bills for a place that usually cost $150 a month to heat. When clients complained, Griddy encouraged them to switch to a fixed-rate provider, even though those companies weren’t able to connect new customers in the middle of a state-wide stormageddon. Around 29,000 Griddy customers ended up with a combined $29 million in energy charges from the company, which is currently both filing for bankruptcy and being sued by the state.

But Griddy was really only the grossest boil at the carbuncle convention. By maintaining its deregulated grid, Texas left itself at the mercy of local power companies, who couldn’t deal with the pressures caused by the storm. And the resulting outages caused at least 57 deaths, with causes ranging from hypothermia to medical equipment failures and carbon monoxide poisoning from trying to run gas generators indoors. In Houston, a grandmother and her three grandchildren were killed in a blaze after lighting a fire to keep warm. Meanwhile, the state’s remaining energy producers reported record profits. One natural gas CFO bragged that his company had hit the “jackpot” as energy prices spiked. And the investment bank behind Griddy reported a $215 million windfall from their other Texas energy investments. We’re sure that good news will really brighten the day for any consumers still juggling overdraft fees while trying to recover thousands of dollars from the Griddy bankruptcy.

Top image: Daria Nipot, Steven Frame