Nicolas Cage Investment Advice: Be In Movies, Buy Everything

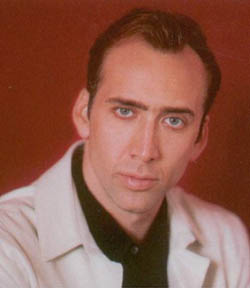

Hi, I'm Nicolas Cage! I'm an Oscar winning actor (!!!) and the star of all your favorite movies! I'm here to give you all the investment advice you'll need to become famous! Now let's begin!

But before we can begin, let's cover some basic definitions first:

Asset

An Asset is something you own that's worth something, like money or hair.

Liability

A Liability is something you own that is not worth something, like your family or joy.

Income

Income is money that comes to you, like flies to a magnet, or honey to a vacuum cleaner.

Expenditure

Expenditures are when money goes away from you, like squirrels do when you try to pet them.

Now let's begin again!

Hi, I'm Nicolas Cage! I'm an Oscar winning actor (!!!) and the star of all your favorite movies! I'm here to give you all the investment advice you'll need to become famous! Now let's begin!

But before we can begin, let's cover some basic definitions first:

Asset

An Asset is something you own that's worth something, like money or hair.

Liability

A Liability is something you own that is not worth something, like your family or joy.

Income

Income is money that comes to you, like flies to a magnet, or honey to a vacuum cleaner.

Expenditure

Expenditures are when money goes away from you, like squirrels do when you try to pet them.

Now let's begin again!

The most important part of the Nicolas Cage Investing System is to remember the Three B's. If it helps, I recommend memorizing the following phrase: "Always remember the Three B's."

The Three B's

The most important part of the Nicolas Cage Investing System is to remember the Three B's. If it helps, I recommend memorizing the following phrase: "Always remember the Three B's."

The Three B's Me, believing in myself.

_________

Me, believing in myself.

_________

When I walk the Earth helping strangers with their investments, I hear a lot of people repeating the same common misconceptions about money and investing. This is my chance to set the record straight!

Misconception 1: Investing is hard

Not true! Investing is easy! It's just that not investing is also easy. Easier in fact. So comparatively, you may have a point.

Misconception 2: Only rich people invest

Again, not so! Everyone can invest! Rich people often make more money investing than everyone else, but money isn't everything! Many people invest because it helps them meet people or become more active!

Misconception 3: The stock market is dangerous

I don't know what that is.

Misconception 4: It's OK to delay planning for retirement

Do you have a job? Every evening you stop working and go home, right? That's retirement! It's already here, every day! And longer on the weekends! You need to start planning now!

When I walk the Earth helping strangers with their investments, I hear a lot of people repeating the same common misconceptions about money and investing. This is my chance to set the record straight!

Misconception 1: Investing is hard

Not true! Investing is easy! It's just that not investing is also easy. Easier in fact. So comparatively, you may have a point.

Misconception 2: Only rich people invest

Again, not so! Everyone can invest! Rich people often make more money investing than everyone else, but money isn't everything! Many people invest because it helps them meet people or become more active!

Misconception 3: The stock market is dangerous

I don't know what that is.

Misconception 4: It's OK to delay planning for retirement

Do you have a job? Every evening you stop working and go home, right? That's retirement! It's already here, every day! And longer on the weekends! You need to start planning now!

Misconception 5: Investing is about earning money quickly

Many investments make no money at all!

Misconception 6: I don't need to diversify

Diversifying is very important. But if you remember your Three B's and "Buy everything you see" you'll find you're automatically diversified! That's the power of my system.

Misconception 7: Try and invest on your own

Investing on your own is easy, but it's easier to get someone else to do it for you. Find a man who knows about money. They usually wear gray suits. They used to wear those green visors, but stopped doing that.

Misconception 8: Pay yourself first

Every time you earn money, give some of it to yourself! You earned it!

__________

Misconception 5: Investing is about earning money quickly

Many investments make no money at all!

Misconception 6: I don't need to diversify

Diversifying is very important. But if you remember your Three B's and "Buy everything you see" you'll find you're automatically diversified! That's the power of my system.

Misconception 7: Try and invest on your own

Investing on your own is easy, but it's easier to get someone else to do it for you. Find a man who knows about money. They usually wear gray suits. They used to wear those green visors, but stopped doing that.

Misconception 8: Pay yourself first

Every time you earn money, give some of it to yourself! You earned it!

__________

Q: What do you know about investing?- H. Jervis, Cincinnati, OH

A: My entire family has been involved in show business for decades, and I've been starring in movies since the age of 18. I would have to say that my favorite director to work with was Ridley Scott. Thanks for your question!

Q: What do you know about investing?- H. Jervis, Cincinnati, OH

A: My entire family has been involved in show business for decades, and I've been starring in movies since the age of 18. I would have to say that my favorite director to work with was Ridley Scott. Thanks for your question!

Me and my good friend Ellen DeGeneres. I often help her with her investments.

Q: What was it like sleeping with Patricia Arquette? She was pretty hot back in the day. – B. Kipson, Los Angeles, CA

A: It was all right!

Q: What are the benefits of a Roth IRA versus a traditional 401k? Also, what was it like sleeping with Patricia Arquette again? – L. Menkinson, Indianapolis, IN

A: Contributions to a Roth IRA are not tax deductible, but most withdrawals will be untaxed. Whether a Roth IRA or traditional IRA is right for you will depend on the marginal tax brackets you're in while contributing and at retirement. And Patricia was wild! Great times!

___________

Me and my good friend Ellen DeGeneres. I often help her with her investments.

Q: What was it like sleeping with Patricia Arquette? She was pretty hot back in the day. – B. Kipson, Los Angeles, CA

A: It was all right!

Q: What are the benefits of a Roth IRA versus a traditional 401k? Also, what was it like sleeping with Patricia Arquette again? – L. Menkinson, Indianapolis, IN

A: Contributions to a Roth IRA are not tax deductible, but most withdrawals will be untaxed. Whether a Roth IRA or traditional IRA is right for you will depend on the marginal tax brackets you're in while contributing and at retirement. And Patricia was wild! Great times!

___________